steel industry

There are many different types of steel depending on the combination of other elements mixed in with the iron and the carbon content in the final product. Varying combinations mean that there are more than 3,500 different grades of steel with many different physical, chemical and environmental properties. As a physical commodity, steel is traded as crude or raw material.

Steel can be easily recycled and traded as scrap metal or melted to create new products.

The steel industry is a very tight market with multiple traders competing for the same clients within their product segment.

petrochimical

Most petrochemical plants are located near oil-producing and oil-refining centres or near natural gas sources due to the difficulty and cost of transporting feedstock (raw materials instrumental in petrochemical manufacturing). The USA (Louisiana and Texas) and Western Europe (the UK and the Netherlands) are home to some largest petrochemical industries however there is major new growth in the Middle East (Saudi Arabia) and Asia (India, China and Japan). China’s aspiration to become self-sufficient in petrochemicals has driven it to become the world’s largest chemicals producer. Physical traders tend to deal in multiple oil products with few trading solely in petrochemicals.

our services

⦁ Petrochemical Products

Petrochemicals are chemical products derived from petroleum or natural gas.

The two most common categories are Olefins and Aromatics. Crude oil and natural gas are refined and processed respectively to produce naphtha, ethane, propane/liquefied petroleum gas (LPG) and methane. A series of further processes such as steam cracking, catalytic reforming and propane dehydrogenation results in a multitude of petrochemicals which eventually make their way in to products which the final customer sees.

⦁ Energy industry

Energy trading involves the buying and selling of various energy commodities such as crude oil, natural gas, wind power and electricity. This form of trading remains popular, as frequent fluctuations in price and volume can create numerous trading opportunities throughout each trading day.

Energy trading is one of the most popular sectors to trade and invest in, due to the constant supply and demand of energy assets. Crude Oil is perhaps the most traded commodity in the world, and some of the biggest blue-chip companies by market capitalization are within the energy sector, including PetroChina, ExxonMobil and BP.

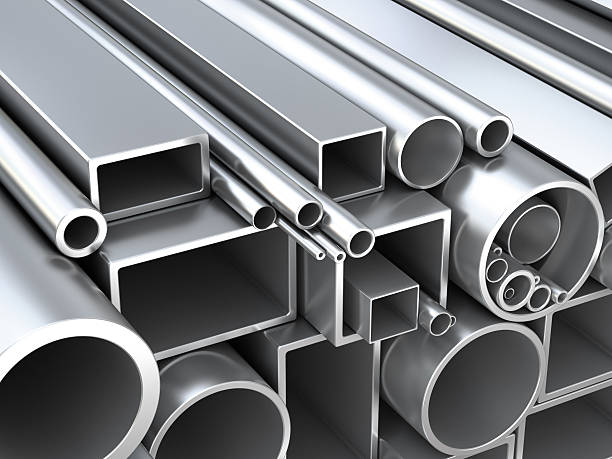

⦁ steel industry

Steel is an important alloy made up of iron and carbon. Adding carbon creates a much stronger substance than pure iron making it ideal for use in the construction of infrastructure such as roads and railways. Steel skeletons are also used to support large modern structures such as stadiums, skyscrapers, bridges, and airports. It is used in every aspect of our lives from surgical scalpels to cargo ships, cars, refrigerators, and washing machines. The incredible strength and durability it exhibits along with its relatively cheap production cost make steel the most widely used metal on Earth.

⦁ steel Raw material

Worldwide iron ore resources are estimated to exceed 800 billion tonnes of crude ore, containing more than 230billion tonnes of iron.6,7

The unprecedented growth of China’s steel production in the 2000s resulted in a very strong growth in global demand for steelmaking materials. Global iron ore exports grew from half a billion tonnes in 2000 to 1.5 billion tonnes in 2016. Australia consolidated its position as the main supplier of steelmaking materials, with iron ore exports growing from about 150 Mt to 800 Mt.

contact us

info@peakcockgreen.com

ROOM B3 . 19/F .TUNG LEE COMMERCIAL BUILDIND . 91-97 JERVOIS STREER . SHEUNGWAN . HONG KONG